Opendoor Technologies Inc (NASDAQ:OPEN) shares are trading approximately flat Wednesday afternoon, as the stock takes a breather following a sharp double-digit rally earlier in the week. Here’s what investors need to know.

- OPEN is facing resistance Wednesday from sellers. Get the complete picture here.

What To Know: While price action has stabilized mid-week, the iBuyer’s stock is up over 10% in the last five days, lifted by a shifting macroeconomic tide that heavily favors interest-rate-sensitive sectors.

The catalyst for the recent surge lies in firming expectations for a Federal Reserve pivot. With markets assigning a 77% probability to a Dec. 10 rate cut and Goldman Sachs forecasting a terminal rate of 3%–3.25% by 2026, investors are repricing Opendoor's outlook.

The company is uniquely positioned to benefit from easing monetary policy in two specific ways: significantly lower daily holding costs on its floating-rate debt and a potential thaw in the housing market's lock-in effect as mortgage rates stabilize.

Read Also: New Meme Stock God Eric Jackson Affirms His Top 2026 Stock Pick

This company-specific momentum coincides with a broader market rotation observed Tuesday, where capital flowed out of high-flying AI chipmakers and into small-cap indices like the Russell 2000.

For Opendoor, this creates a dual-threat turnaround narrative, benefitting from both sector rotation and a direct reduction in capital expenses.

Meanwhile, Wednesday's trading action suggests investors are awaiting concrete confirmation of the policy timeline in December.

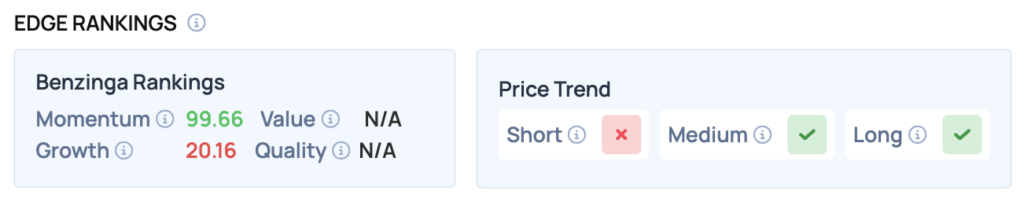

Benzinga Edge Rankings: Underscoring the strength of the recent breakout, Benzinga Edge data currently assigns Opendoor a nearly perfect Momentum score of 99.66.

OPEN Price Action: Opendoor Technologies shares were down 0.89% at $7.67 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: Apple Stock Breaks To All-Time Highs -- Succession Clarity Unlocks New Chapter

How To Buy OPEN Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Opendoor Technologies’ case, it is in the Real Estate sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock