Universal Technical Institute (NYSE:UTI) has declined over 20% in recent sessions. An analysis under the Adhishthana framework shows that this weakness is consistent with the stock's current phase in its cycle, suggesting the downside may not be fully played out. Here's a breakdown of its cycle structure and the factors driving this move.

Analysing Universal Technical Institute's Cycle

The stock is currently in Phase 11 of its 18-phase Adhishthana Cycle on the weekly charts. To understand why the decline is showing up now, we need to step back and analyze the stock's broader cycle, beginning with Phase 4.

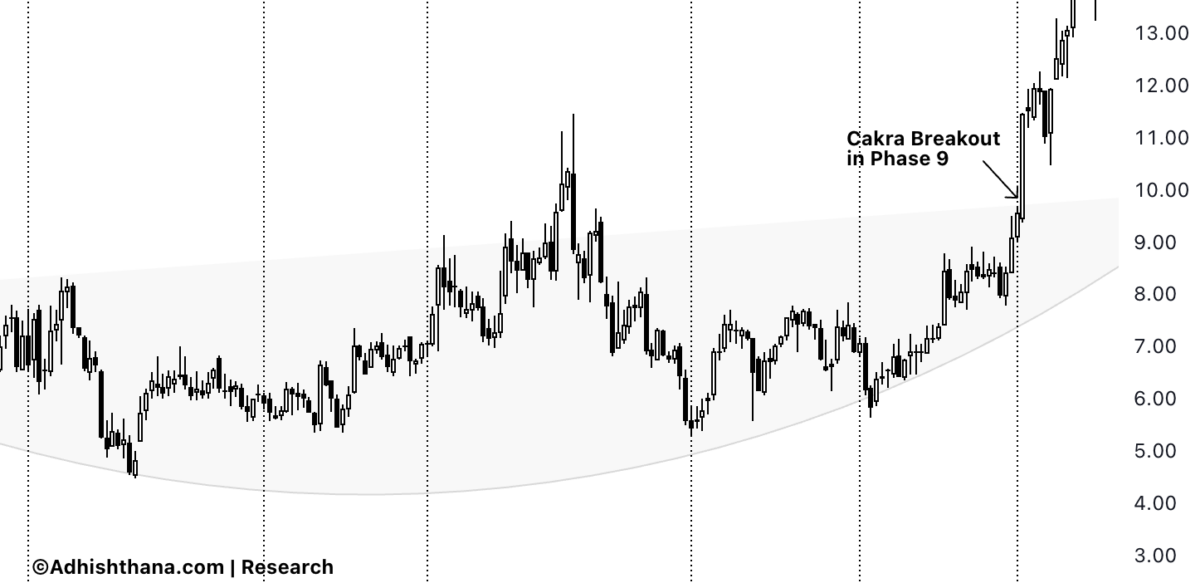

According to the Adhishthana Principles, stocks typically form a Cakra structure between Phases 4–8, a channel-like arc that usually carries bullish implications. A clean breakout in Phase 9 triggers the start of the Himalayan Formation, a powerful three-legged move consisting of an ascent, peak, and descent.

Universal Technical Institute entered its Cakra formation in June 2020, and through the end of Phase 8, the stock consistently respected the structure. In Phase 9, the stock broke out exactly as the principles suggest, officially beginning its Himalayan Formation.

The Three-Legged Formation In Play

After the breakout in Phase 9:

- The stock rallied ~77% in Phase 9

- It then strengthened further in Phase 10, rising ~101%

Under the principles, the peak of the Himalayan Formation typically appears in Phase 10 or Phase 11. Because no peak was confirmed in Phase 10, Phase 11 became the natural window for peak formation. As Phase 11 began, the stock topped near $36, marking the start of the descent leg. Since then, the stock has fallen roughly 38%, consistent with the expected structure of the formation.

What's Ahead for Universal Technical Institute?

The descent leg concludes only when the underlying returns to the Cakra breakout level, in this case, around $10.

Given this framework, the ongoing decline aligns cleanly with the Adhishthana structure. The selling pressure is not irregular; it is part of the natural unwinding of the formation.

Investor Outlook

With the descent leg still unfolding, Universal Technical Institute is not yet a value play. Investors looking to buy may want to stay patient, the stock's structural cycle suggests lower levels ahead before stability returns.