Par Pacific Holdings Inc. (NYSE:PARR) is currently in Phase 17 of its 18-phase Adhishthana Cycle on the weekly charts, and the stock has been on a remarkable run. Since May, it has surged from around $14 to near $45, hovering around its all-time highs. While the momentum appears strong, the Adhishthana framework reveals one critical warning sign investors should pay attention to.

Analysing Par Pacific's Triads: The Missing Link

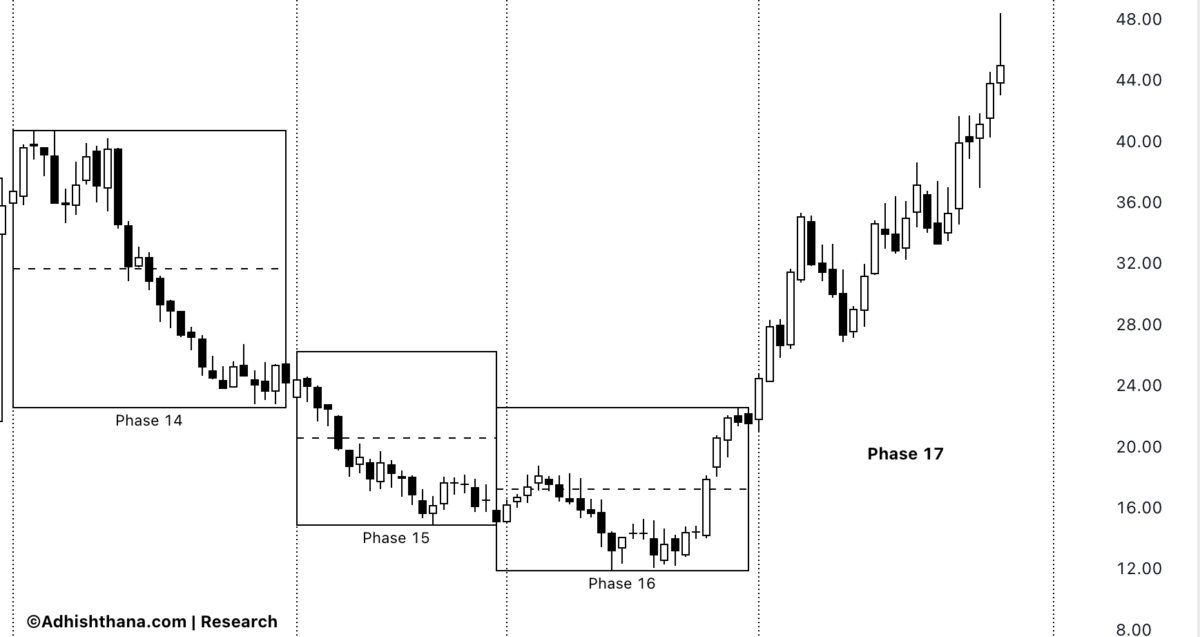

In the Adhishthana framework, Phases 14, 15, and 16 together form the Guna Triads. These three phases determine whether a stock will achieve a Nirvana move in Phase 18, the pinnacle stage of the cycle.

For Nirvana to occur, the triads must display Satoguna: a clean, stable, sustainable bullishness.

As I outlined in my book Adhishthana: The Principles That Govern Wealth, Time & Tragedy:

"Without noticeable Satoguna in any of the triads, no Nirvana can emerge in Phase 18."

Par Pacific entered its triads in January 2024, but instead of strength, the stock saw persistent weakness. Across these three phases, the stock declined nearly 70%, signalling clear structural underperformance. Such a triad formation rules out the possibility of a Phase 18 Nirvana move.

As a result, when Par transitions into Phase 18 in late December 2025, the stock is expected to trade with consolidation, sluggishness, and weaker long-term momentum, not the explosive upside typically associated with Nirvana phases.

Investor Outlook

With the triads showing no Satoguna, the long-term outlook dims despite the impressive rally into Phase 17.

- For current holders: Consider hedging your long positions as Phase 18 approaches, given the historically weak performance that follows poor triad structures.

- For prospective buyers: Avoid chasing the current rally. Phase 18 may offer better, more value-oriented entry points once the expected consolidation begins.

Related Content

Also read our commentary on Six Flags Entertainment Corporation, which is also in Phase 17 and experienced a similarly weak triad formation.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.