Ever since April this year, Nebius Group's (NASDAQ:NBIS) stock has staged a steep rally, soaring from the lows of $18 to as high as $140. However, when this move is analyzed under the lens of the Adhishthana Principles, the framework suggests that the rally might not carry much long-term value. Here's why the current cycle indicates potential underperformance ahead.

Analyzing Nebius Group's Triads

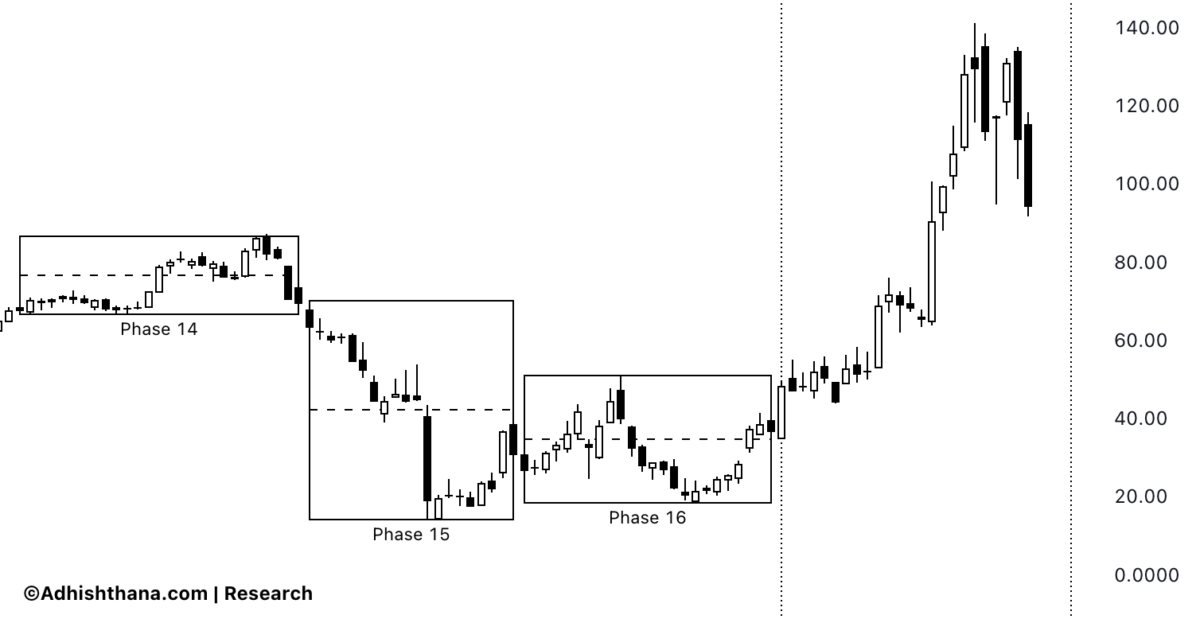

Nebius Group is currently in Phase 17 of its 18-phase Adhishthana Cycle, and to understand what lies ahead, it's crucial to review its Guna Triads.

In the Adhishthana framework, Phases 14, 15, and 16 together form the Guna Triads. These are key intervals that determine whether a stock can reach Nirvana in Phase 18, the peak of its cycle.

For a Nirvana move to emerge, these triads must exhibit Satoguna; a clean, sustainable bullish rally. Without Satoguna, no Nirvana can occur.

As I wrote in Adhishthana: The Principles That Govern Wealth, Time & Tragedy:

"Without noticeable Satoguna in any of the triads, no Nirvana can emerge in Phase 18."

In Nebius Group's case, the stock entered its Phase 14 in June 2021, and across all three triads, it traded with sharp bearishness and consolidation. In fact, the stock declined by nearly 83% through its triad phases, a clear indication that a Nirvana move in Phase 18 is off the table.

Currently, the stock sits in Phase 17, where it has been rallying sharply. However, according to the principles, Phase 17 is a no-trade phase. Therefore, any rallies that occur here should not be chased.

The stock transitions into Phase 18 in December 2025, which historically brings sluggish or range-bound trading for such triad structures. In line with that, the recent retracement from 140 to 94 already hints at exhaustion.

This weakness is also visible in its recent earnings, where the losses widened by 153%, signaling that the rally may be losing steam.

Investor Outlook

With a poor triad formation in place, Nebius Group's recent surge appears to lack structural strength under the Adhishthana framework. Investors should be cautious, as the stock transitions into Phase 18, it's likely to trade with a bearish bias and extended consolidation until at least mid-2027.

While new deals with Meta may strengthen business fundamentals, from a cyclical perspective, the stock seems due for cooling off before any meaningful upside emerges. For now, it may be wise for investors to wait for the rally to settle and look for value opportunities later once the cycle resets.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.