Shares of Palantir Technologies Inc (NASDAQ:PLTR) are trading lower Wednesday morning amid overall tech stock weakness. The stock is moving against a backdrop of recent strategic validation and partnership news.

- PLTR is taking a hit from negative sentiment. Check the analyst take here.

What To Know: The data analytics firm received a nod from Oracle co-founder Larry Ellison, who recently stated that AI will only reach its “peak value” once models are trained on privately owned data.

This thesis directly affirms Palantir’s long-standing business model, which focuses on deploying its Foundry and AIP platforms within secure government and corporate data environments.

Reinforcing its market position, Palantir also recently announced a key partnership with data cloud giant Snowflake. The integration aims to provide customers seamless, bidirectional data access, helping accelerate the deployment of AI agents without complex data duplication.

These developments highlight Palantir’s focus on converting AI hype into tangible, revenue-generating contracts. Investors are now looking ahead to the company’s next earnings report on Nov. 3, where Wall Street analysts expect an EPS of 15 cents on quarterly revenue of $1.09 billion.

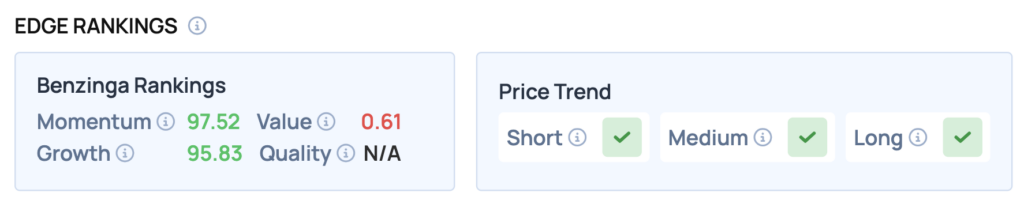

Benzinga Edge Rankings: Despite Wednesday’s dip, Benzinga Edge rankings highlight the stock’s powerful recent performance, awarding Palantir a Momentum score of 97.52.

PLTR Price Action: Palantir shares were down 5.47% at $171.57 at the time of publication on Wednesday, according to data from Benzinga Pro. The stock is approaching its 52-week high of $190.00.

Currently, Palantir is trading approximately 0.2% below its 50-day moving average of $171.99, suggesting that it is hovering near a critical support level. The calculated support level stands at $170.77, which could provide a buffer against further declines.

Should the stock break below this level, it may test the 200-day moving average at $127.72, a significant distance away that underscores the stock’s recent momentum.

Read Also: Trump Wanted Clean Energy Dead--It’s Crushing Nvidia And AI Instead

How To Buy PLTR Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Palantir Technologies’ case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock