Prestige Consumer Healthcare (NYSE:PBH) is currently in Phase 10 of its 18-phase Adhishthana cycle on the weekly charts, and the stock has been in a relentless downtrend since June 2025. Here's why the stock has been falling, and what lies ahead under the lens of the Adhishthana Principles.

Prestige Consumer Halthcare's Downward Trend Explained

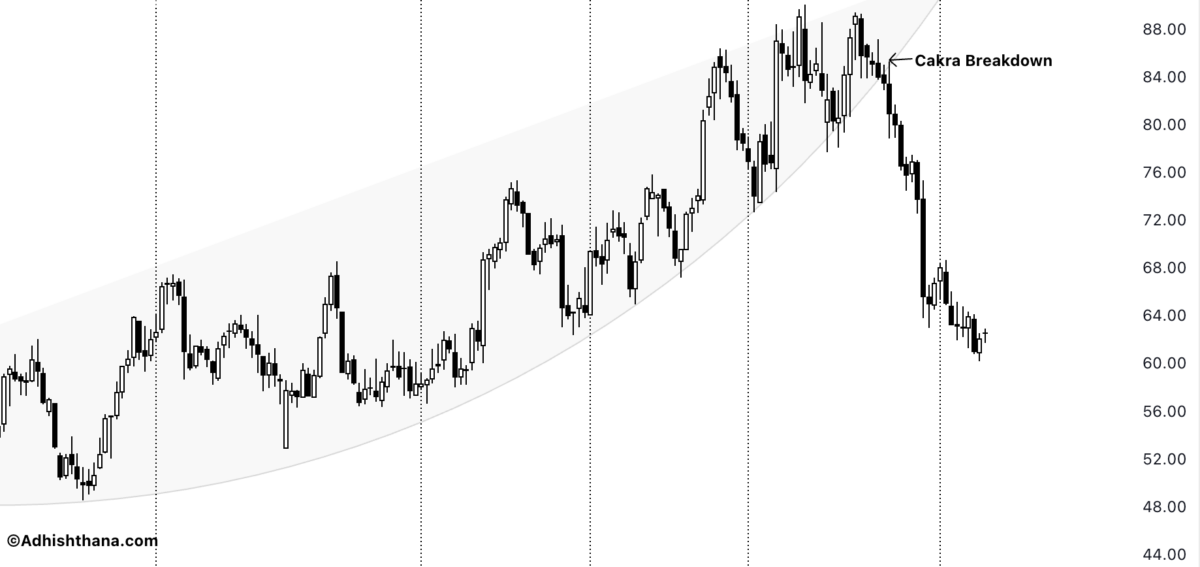

According to the Adhishthana framework, stocks typically form a Cakra structure between Phases 4 and 8, a channel-like setup with an arc that generally carries bullish implications. A clean breakout in Phase 9 usually kicks off the Himalayan Formation, a powerful bullish leg.

PBH followed this pattern until Phase 9, where its outlook shifted. The stock entered Phase 4 in August 2021, beginning its Cakra formation and trading neatly within its arc through Phase 8. However, upon entering Phase 9, the stock did not break out to the upside. Instead, it broke down, triggering what is referred to as the Move of Pralaya within the Adhishthana Principles.

As I outlined in Adhishthana: The Principles That Govern Wealth, Time & Tragedy:

"When the underlying breaks the Cakra on the flip side, consolidation typically extends into the Guna Triads. The move that follows is highly significant, and selling pressure can be extremely strong. This is called the Move of Pralaya."

True to the principles, once Prestige Consumer Healthcare broke below the lower bound of its Cakra, the stock faced sharp selling pressure, falling nearly 29% since the breakdown.

Investor Outlook

With the Move of Pralaya now active, the selling pressure is unlikely to be over anytime soon. The underperformance may persist until the Guna Triads arrive, at which point the stock's structure can be re-evaluated on the weekly chart.

For now, those viewing PBH as a "value buy" may be premature in their assessment. The Cakra breakdown often signals deeper structural or fundamental issues within the stock, and buying during such a phase would not be advisable under the Adhishthana framework.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.