Alignment Healthcare Inc. (NASDAQ:ALHC) witnessed a 23.08% surge in its stock price during premarket trading on Thursday, after the company’s second-quarter earnings beat market expectations.

Check out how ALHC stock is trading here.

What Happened: The California-based healthcare company reported a total revenue of $1 billion in the second quarter, with a health plan membership of 223,700 as of June 30.

John Kao, the founder and CEO of Alignment Healthcare, noted, "In today’s Medicare Advantage environment, Alignment Healthcare’s second quarter performance proves that strong financial results and high-quality care can go hand in hand – with the right model."

See Also: Billionaire Peter Thiel-Backed Crypto Startup Plasma Raises $20M To Develop Bitcoin-Based Stablecoin Network

Following the announcement, the company’s stock price surged by 10.36% to $13 during regular trading hours on Wednesday. The stock surged 23.08% to $16 during premarket trading.

Why It Matters: Alignment Healthcare beat expectations for the second quarter, delivering stronger-than-anticipated results across membership, revenue, profit, and earnings.

The company added more health plan members, bringing the total to about 223,700 -- nearly 28% more than a year ago -- and pulled in over $1 billion in revenue, up 49%.

It also posted a solid adjusted gross profit of $135.2 million and adjusted EBITDA of $45.9 million. With the strong performance, Alignment raised its full-year forecast across all these key areas.

This strong performance also follows the company’s recent decision to raise its full-year sales guidance from $3.77 billion-$3.81 billion to $3.8 billion-$3.91 billion, surpassing the $3.80 billion estimate.

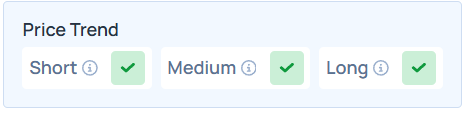

Benzinga's Edge Stock Rankings indicate ALHC stock has a positive trend across all time frames. Here is how the stock fares on other parameters.

- Read Next: Trump Leaves ‘Good Friend’ India In The Cold, Strikes Trade Deal With Arch Rival Pakistan Over ‘Massive Oil Reserves’

Photo:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: khunkornStudio via Shutterstock