CARS (NYSE:CARS) is currently in Phase 11 of its 18-Phase Adhishthana Cycle. While the stock may look attractive from a value standpoint, its structure still signals time and patience. Here's what's playing out under the Adhishthana framework.

Breakdown from the Cakra: Why CARS Isn't Rallying Yet

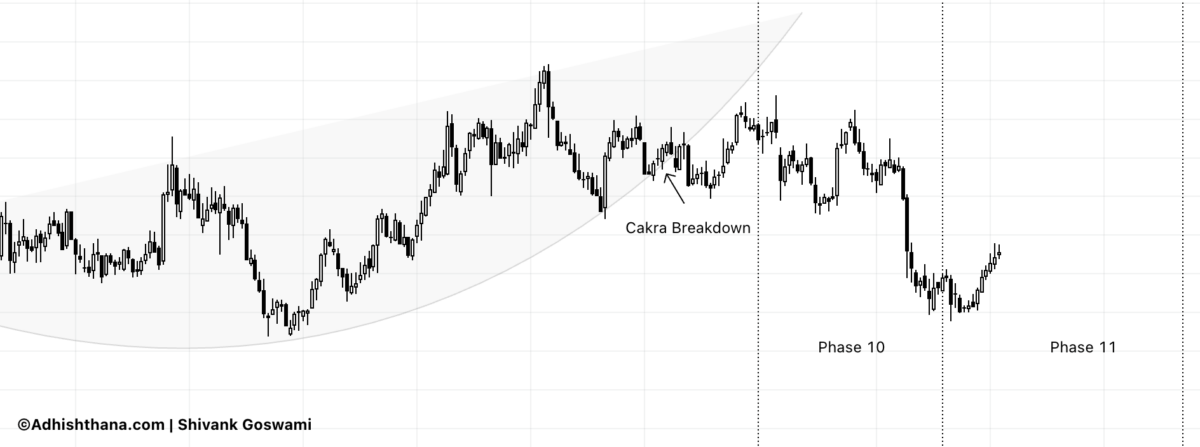

Under Adhishthana Principles, stocks form a structure known as the Adhishthana Cakra between Phases 4 and 8 -- usually an arc or consolidation zone. A breakout in Phase 9 signals the start of a strong upward Himalayan move.

CARS did build the Cakra through Phases 4 to 8, but instead of breaking out in Phase 9, it broke down sharply. That triggered the infamous Move of Pralay.

“When the underlying breaks the CÄkra on the flip side, it typically draws consolidation up to the Guna triads. The movement after the break is typically highly significant, and the selling momentum is extremely strong.” -- Adhishthana: The Principles That Govern Wealth, Time & Tragedy

The stock fell from the $20 zone to as low as $9. Now in Phase 11, the structure still signals consolidation ahead. The key shift will only come with the Guna Triads, which begin in Phase 14. Until then, there's no structural confirmation of an upward trend.

Monthly Buddhi Move in Play: A Bullish Setup or a False Start?

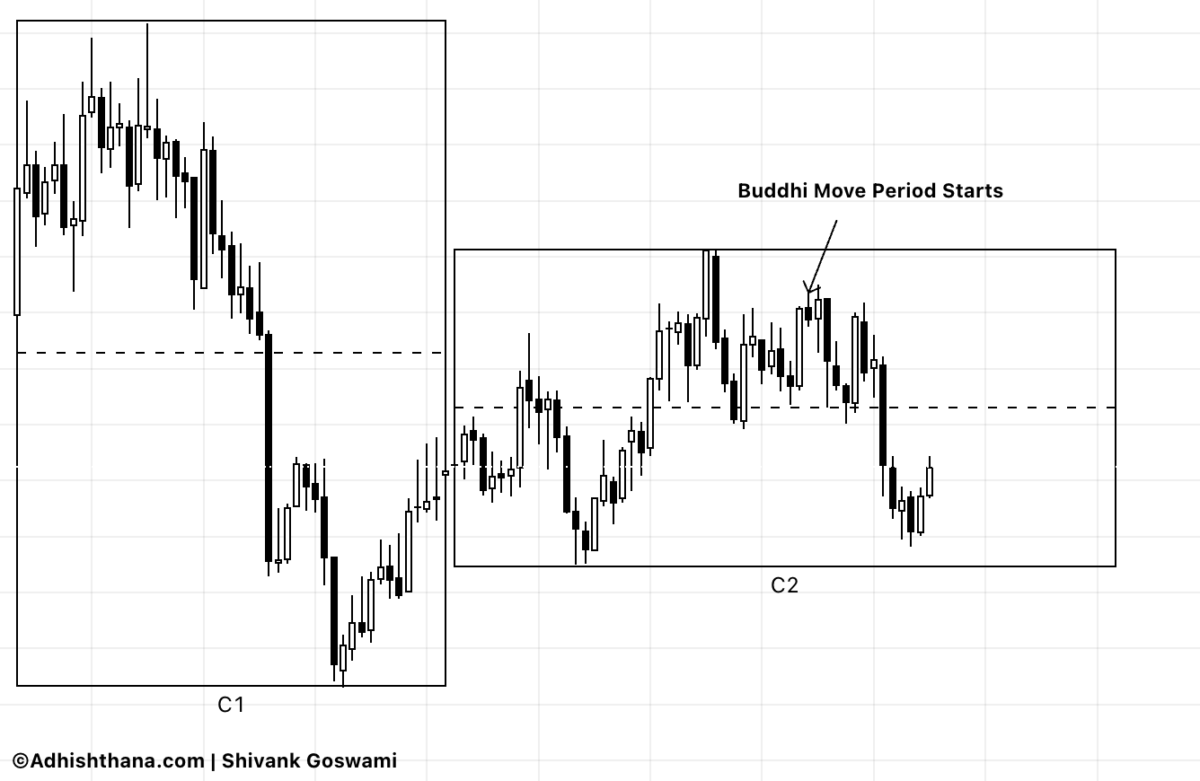

While the weekly chart reflects weakness, the monthly chart adds some intrigue. CARS is currently in the latter part of Phase 2 -- the Buddhi Move. This phase is often bullish, but only if the prior Sankhya period was formed correctly.

In this case, CARS didn't collapse during its Sankhya period but traded in a wide range, which does check out under the rules. That keeps the door open for a potential Buddhi rally. However, there's a timing mismatch. The Phase 2 ends in March 2027, while the Guna Triads (on the weekly) begin in May 2027. That raises questions. If the Guna Triads are supposed to confirm long-term potential, can a true rally happen before they even begin?

What Should Investors Do?

The stock is bouncing from the $9 to $10 range for the third time, making it look like a value buy. But with the weekly structure still unclear and the Buddhi move not fully confirmed, it's a tough call.

Existing investors can hold, especially those with long-term patience. For fresh entries, it’s best to wait for structural confirmation, most likely after Phase 14 begins. Until then, CARS looks like a car stuck in neutral -- promising on paper, but waiting for the right engine to kick in.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.