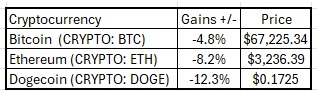

Major cryptocurrencies dropped on Friday, with $877.8 million liquidations in the crypto derivatives market.

What Happened: Cryptocurrency markets were weighed down by risk-off sentiment in traditional markets amid heightened geopolitical risks. U.S. stock markets dropped on fears of a broadening conflict in the Middle East, after U.S. authorities indicated that Iran could prepare to launch a significant attack on Israel.

The global cryptocurrency market cap now stands at $2.53 trillion, down 3.35% in the past 24 hours.

Over $877.8 million in total positions have been liquidated, with $841.6 million alone wiped out in the past 12 hours. Long positions accounted for $782.5 million in the past 14 hours.

A total of 276,647 traders were liquidated, with the largest single liquidation occurring on OKX in the ETH-USD-SWAP value of $7.19M.

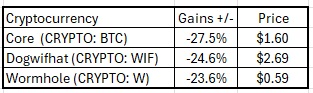

Top Losers (24 Hour)

Analyst Notes: Crypto, stock and market education account Income Sharks said Bitcoin traders and investors should just set alerts at $60,000 and $74,000 and walk away.

Heavily-followed crypto trader Cold Blooded Shiller said in a detailed X post that the current market is "offering a significant discount on some markets in a bull run."

He went on to say that the aggressive moves in the market are likely to lead to chop and continuation lower and it is very important to manage risk and also understand it may not be "an immediate V-recovery." Investors should net "get chopped up in the time in between the next sizeable move."

His tweet concludes, "This is your opportunity zone building," though not immediately. "This isn’t the time to be overexposing, You have plenty of time to build."

What's Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga's upcoming Future of Digital Assets event on Nov. 19.

Read Next: Peter Schiff Predicts Bitcoin ETFs Will Lead To Its ‘Biggest Crash Ever’

Image: Shutterstock