In a bid to mirror the success of FAANG stocks, BofA Securities analyst Vivek Arya introduced a novel grouping in the semiconductor sector known as MANGO.

Comprising Marvell Technology Inc (NASDAQ:MRVL), Advanced Micro Devices (NASDAQ:AMD), Analog Devices Inc (NASDAQ:ADI), Broadcom Inc (NASDAQ:AVGO), Nvidia Corp (NASDAQ:NVDA), GlobalFoundries Inc (NASDAQ:GFS), and On Semiconductor Corp (NASDAQ:ON), the MANGO portfolio seeks to capture the essence of industry leaders in the semiconductor domain.

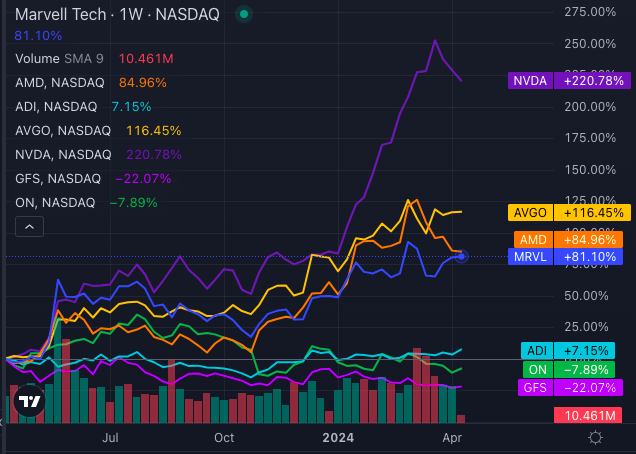

Nvidia, Broadcom Lead, While GFS, OnSemi Lag for Performance

Chart Source: Benzinga Pro, Data source: TradingView

A look at the one-year price performance showed MANGO stocks exhibit a mix of growth trajectories. Nvidia leads the pack with an impressive surge of +220.78%, followed by Broadcom of +116.45% and Advanced Micro Devices of +84.96%. Marvell Technology and Analog Devices also showcased notable gains, while GlobalFoundries and Onsemi presented more modest figures, with declines of -22.07% and -7.89%, respectively.

Also Read: Not Nvidia Or Super Micro, But These Stocks Have A Better Growth Story Than Tesla And Apple, Says Expert

Which MANGO Stock Is Most Undervalued Right Now

Delving into the valuation metrics, we observed variations across the MANGO stocks.

Benzinga looked at the MANGO stocks — Marvell Technology, Advanced Micro Devices, Analog Devices, Broadcom, Nvidia, GlobalFoundries and On Semiconductor — to figure out which stock appeared to be the most undervalued right now.

Benzinga looked into two multiples to get a clearer picture on valuations:

- Price-to-Earnings (P/E) Ratio: so investors can assess the relative valuation of MANGO stocks based on their earnings generation.

- Enterprise Value-to-Sales (EV/Sales) Ratio: MANGO stocks may not have consistent profits but have strong revenue growth.

| Stock | P/E FWD | EV / Sales |

| Nvidia | 35.12 | 34.96 |

| On Semiconductor | 16.05 | 3.72 |

| Broadcom | 28.27 | 17.58 |

| Analog Devices | 32.67 | 8.93 |

| GlobalFoundaries | 37.89 | 3.56 |

| Advanced Micro Devices | 47.35 | 11.99 |

| Marvell Technology | 50.1 | 11.93 |

Data source: Seeking Alpha

Nvidia maintains a P/E ratio of 35.12 and an EV/Sales ratio of 34.96, reflecting its robust market position. Conversely, ON Semiconductor emerges as a potential undervalued gem with a comparatively lower P/E ratio of 16.05 and an attractive EV/Sales ratio of 3.72.

Notably, GlobalFoundries also boasts a healthy EV/Sales multiple, indicating favorable market sentiment despite recent declines.

13% -18% Upside From These Undervalued Gems

Analysts offered a nuanced view of MANGO stocks. Benzinga looked into the undervalued gems and figured:

- ON Semiconductor commanded a consensus price target of $83.97, suggesting an implied upside of 18.35% based on recent analyst ratings.

- GlobalFoundries was pegged with a consensus price target of $69.71, hinting at a potential 12.27% upside, as per the latest analyst assessments.

The emergence of the MANGO stocks underscored the semiconductor sector’s endeavor to emulate the success of tech behemoths like FAANG.

With varied performance trajectories and distinct valuation metrics, investors have diverse options to consider within the MANGO portfolio.

As the semiconductor industry evolves, prudent analysis and strategic investment decisions will be pivotal in navigating this dynamic landscape.

Read Next: Ahead Of Chip Earnings, Analyst Turns More Bullish On Nvidia And These Semiconductor Stocks On Robust AI Demand

Photo: Shutterstock