The RealReal Inc. (NASDAQ:REAL) recently made headlines after surging over 35% following a strong Q3 earnings report. Under the Adhishthana framework, this rally seems to have deeper structural roots. Here's a breakdown of what's driving the momentum, and what could lie ahead for the stock.

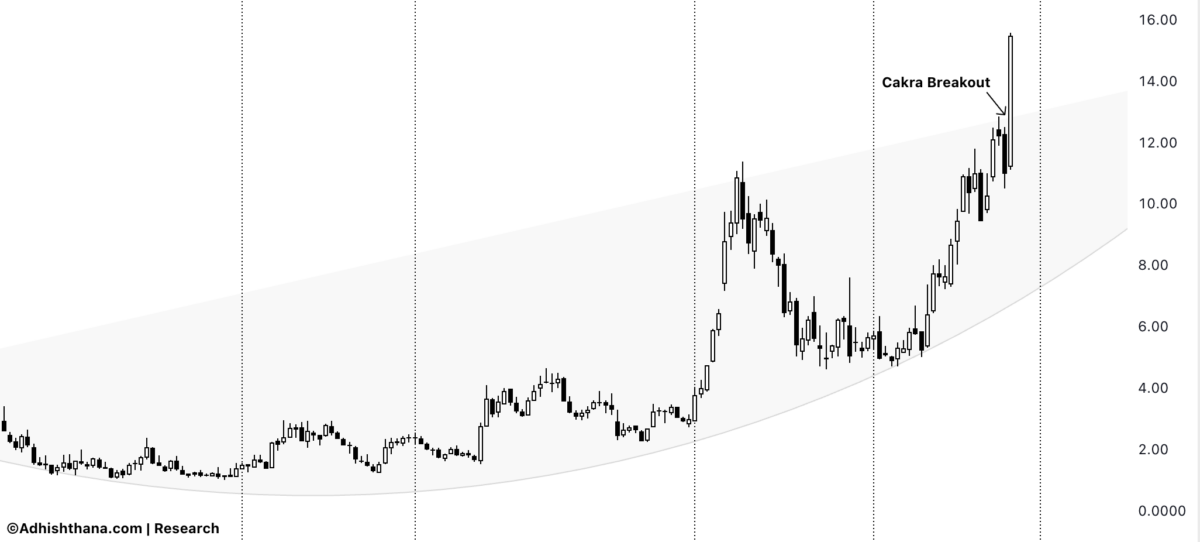

Real Stock's Cakra Formation and Weekly Chart

According to the Adhishthana Principles, stocks typically form a Cakra structure between Phases 4–8. This formation, often resembling a channel with an arc, generally carries bullish implications. The breakout from this structure in Phase 9 typically marks the start of the Himalayan Formation, a strong, sustained bullish move.

The stock is currently in Phase 8, the final stage of its Cakra formation. The stock began this phase back in August 2022, steadily trading within the Cakra boundaries ever since. Recently, it broke out of the Cakra on the upside, signaling the beginning of a new bullish trajectory.

While such a breakout typically occurs in Phase 9 (beginning in December 2025), this slightly early breakout isn't concerning, as it's happening toward the closing stretch of Phase 8. The stock appears to have already begun its Himalayan Formation, signaling the onset of strong bullish momentum. If this move sustains, the rally could extend well into Phase 10, where a peak formation generally develops. That said, it's important to look at the monthly chart to confirm whether this rally is emerging at the right stage of the cycle.

Analysing The Monthly Chart

On the monthly charts, The RealReal Inc. is currently in Phase 2 of its Adhishthana cycle.

According to the principles, Phase 2 unfolds in two distinct parts:

- Sankhya Period: Marked by consolidation or weakness.

- Buddhi Period: Known for powerful and sustained rallies.

The Real Real transitioned into its Buddhi period on November 3, and the recent 35% rally aligns perfectly with this transition, reflecting the typical bullish energy of this period.

While the stock appeared to rally during its Sankhya period, over 80% of that Sankhya period was characterized by consolidation, not directional momentum. This supports the case that the current rally represents a legitimate Buddhi-phase breakout, not an overextended move, further making the case stronger for the bulls.

Investor Outlook

With a Cakra breakout on the weekly chart and a Buddhi-period transition on the monthly chart, RealReal appears to be favoring the bulls.

- For existing holders: Continue to hold your positions, as the structural and cyclical alignment suggests more upside potential ahead.

- For new investors: Avoid chasing the current rally. Given that the cakra breakout came slightly early, short-term volatility or retracement toward the breakout zone around $13 is possible. That level may offer a more attractive entry point before the stock resumes its longer-term bullish trajectory.

In summary, RealReal's surge isn't merely a reaction to strong earnings; it's a move perfectly aligned with where the stock stands in its Adhishthana Cycle.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.